Using proprietary formulas, we calculate the 5-year costs for the seven cost categories that make up the TCO® (car depreciation, insurance, financing, taxes & fees, fuel, maintenance and repairs).

#DEPRECIATION CALCULATOR FULL#

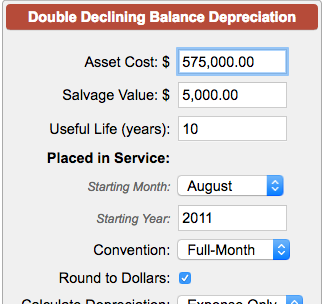

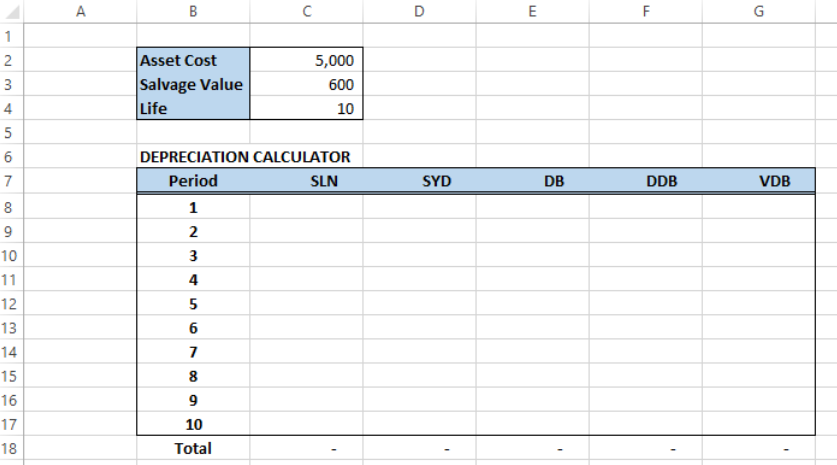

Real Estate Property Depreciation CalculatorĬalculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. VDB (cost, salvage, life, start_period, end_period, factor, no_switch). Calculate depreciation for any chosen range of periods and create a variable declining balance method depreciation schedule. Variable Declining Balance Depreciation CalculatorĬombined declining balance method and straight line method. Based on Excel® formulas forįixed Declining Balance Depreciation CalculatorĭB (cost,salvage,life,period,month), will calculate depreciation at a fixed rate as a function of (Salvage/Cost)^(1/Life) Based on Excel® formulas forĭDB (cost,salvage,life,period,factor) with factor fixed at 2.ĭeclining Balance Depreciation CalculatorĬhoose declining rate, calculate the depreciation for any chosen period and create a declining balance method depreciation schedule. Based on Excel® formulas forĭouble Declining Balance Depreciation CalculatorĬalculate the depreciation for any chosen period and create a double declining balance method depreciation schedule.

Also includes a specialized real estate property calculator.Ĭalculate depreciation, compare methods and print schedules for the most common depreciation methods including straight line, double declining balance, sum of years' digits and units of production.Ĭalculate depreciation used for any period and create a straight line method depreciation schedule. Depreciation calculators online for primary methods of depreciation including the ability to create and print depreciation schedules.

0 kommentar(er)

0 kommentar(er)